Introduction

Please don't judge us for using a cute dog image to soften the blow for what is otherwise a VERY boring post. We apologise in advance for the tedium to come. If you really want a silver lining, it's that you can easily skip ahead to the topic of greatest interest to you

Back in October, Futuro posted an article about the new Child Care Subsidy (CCS) reforms, due to come into effect in July 2023 ('Childcare Subsidy Reforms - Update'). If you're after a high level overview, we recommend staring with our earlier post.

Background

The CCS provides families with financial assistance towards the cost of childcare. Currently, the CCS can reduce fees for families by up to 85%, and up to 95% for siblings, although this is changing slightly in July 2023 (see below). There are also additional subsidies available for families to help with the cost of care that we will explore in a separate post (NSW Universal Pre-Kinder Program, ACCS, ISS, NDIS).

The way that the CCS is calculated is complex, but broadly the rate of subsidy is dependent on:

- Your family’s combined income;

- The number of children in care; and

- Your hours of ‘activity’ per week (see 'Activity test' below).

Your child also needs to be up to date with their immunisations and parents need to meet the Government's residency requirements.

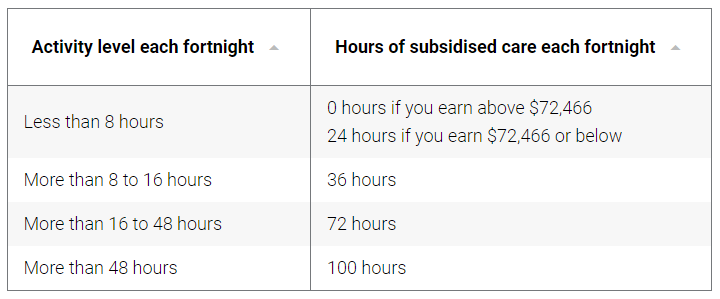

'Activity' test

The number of hours that you work each fortnight will determine the number of hours of care for which you can claim the Child Care Subsidy. ‘Activity’ encompasses many things including:

- Work (including self-employment)

- Time commuting to and from work

- Training

- Study

- Recognised voluntary work

- Unpaid work in a family business

- Looking for work

Families can also access up to 36 hours of care per fortnight if their only activity is volunteering or actively looking for work (for a minimum of 8 hours per fortnight).

Services Australia can do random spot checks of families' declared hours of activity, and may request to see proof of activity hours over a short period. There isn't much data available on how often such spot checks take place and in our personal experience, they appear to be quite rare.

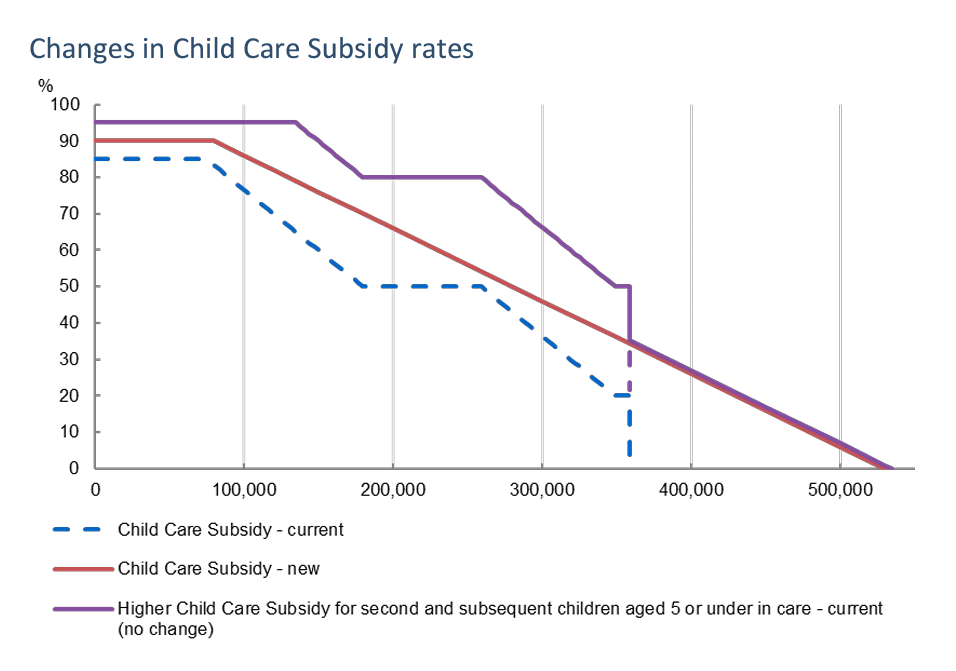

Income test

The amount you will contribute is based on your family’s combined income, with increased income resulting in a smaller subsidy. A graph that shows how the subsidy tapers by income appears below.

Providing income estimates

When you register for the CCS, Services Australia will ask you for an income estimate. If you don't provide one, they will make their own estimate based on your last tax return. If your income varies over time, you can hop into your Centrelink account and update your income as it changes.

At the end of the financial year, Centrelink will reconcile your declared income with your tax return, and make any adjustments required to your CCS entitlements. For that purpose, 5% of your CCS entitlements are withheld throughout the year, and that 5% will be used to pay any CCS that has been over-paid. If your declarations are correct and CCS has not been over-paid, you will receive that 5% withholding back.

A recent evaluation found that a large proportion of families worry about under or over-declaring their income, erring on the side of caution and over-declaring their income to ensure that they don't risk having a debt at the end of the financial year. This evaluation found that 16% of families came away with a debt at the end of the financial year (not including those families with debts that could be set off against the 5% withholding). The average debt for those families was $1059.

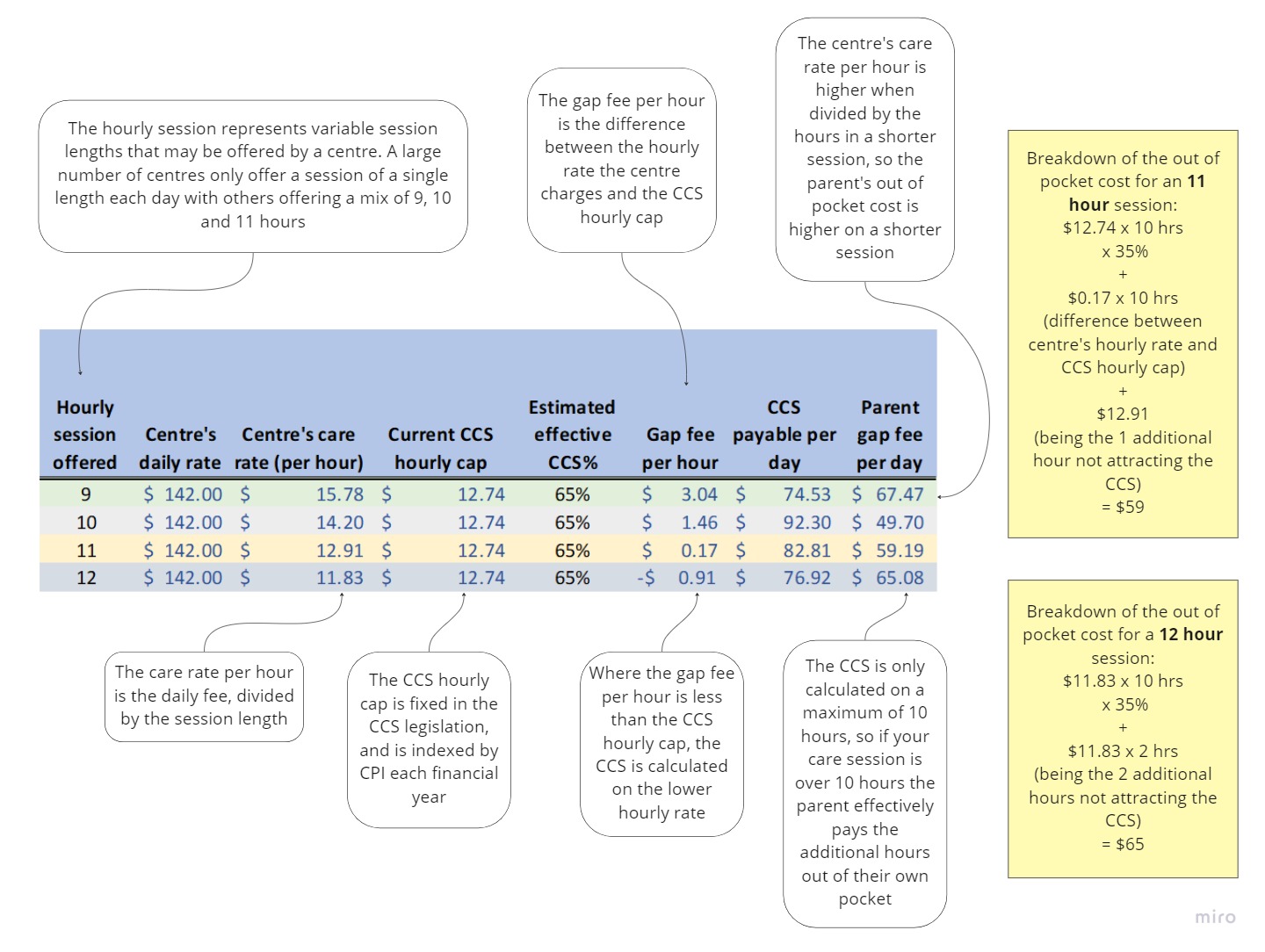

Hourly caps

The CCS is administered on an hourly basis. This can be confusing for families, as most centres charge a daily rate for care. The reason for this is that most centre staff want to work a full day, so it's challenging to staff shorter sessions of care.

In order to administer the CCS, the Government will take the number of hours in a care session (usually, 10 or 11 hours) and divide the daily rate to come up with an hourly cost of care. However, the CCS will only be paid up to an hourly cap. At the time of writing this article, the hourly cap is $12.74 for long day care services for children under school age. The hourly cap increases by CPI each financial year. If the centre charges an hourly rate over $12.74, the CCS will only be calculated on the lower rate. An example of how this looks in practice appears below.

Fortnightly caps

Subject to their levels of activity, families can claim the rebate on either 36, 72 or 100 hours of care each fortnight. A recent evaluation of the CCS found that the majority of families are eligible for 100 hours of care each fortnight (64.2%). Because many centres are open 11 or 12 hours a day, centres will often offer families the option of a 10 hour session in order to maximise the CCS (subject to their level of entitlement).

The ability to select a 10 hour session of care affects families entitled to 100 hours across the fortnight, as it means that they can access 5 days a week of care with each day on a 10 hour session. Families entitled to 36 or 72 hours of care may prefer a 9 hour session.

The 'effective' CCS rate

The 'effective' CCS rate is different from your CCS entitlement. This can be confusing, as families may receive a notification from Centrelink that their CCS entitlement is 85%, but the 'effective' CCS rate looks more like 80% once the following factors are taken into account:

- the 5% withholding rate

- hourly caps

- the activity test

- the length of care sessions

Absences from care

If your child misses a day of care due to sickness or for a holiday, you can still claim the CCS on that day for up to 42 days in a financial year. You can only claim the CCS on an absent day if you have been charged a fee by the centre for that day. There are some circumstances in which the 42 day limit can be waived.

Example

The following example demonstrates the impact that the session length and hourly cap can have on parents' out of pocket fee each day. We add the heavy caveat that this is an example only - individual parents' entitlements are impacted by such a wide range of variables that it simply isn't possible to give one example that will be accurate for all.

This example includes the following assumptions:

- an 'effective' CCS rate of 65%

- a daily rate of $142

- the option of selecting sessions ranging in length from 9-12 hours

The example below doesn't account for any other entitlements like the ACCS, of activity test waivers etc.

In order to work out entitlements for your own family, visit Centrelink's website where they've put together a CCS Calculator.

Higher subsidies for additional children

At the beginning of the 2022 calendar year, the Morrison Government announced a change to the CCS so that families with more than one child can receive a higher subsidy for the each additional child enrolled in care. The higher subsidy rate works out as a 30% increase on the family’s income tested rate, up to maximum of 95% of the daily rate. These reforms are being retained as part of the new CCS package.

What changes in July?

The maximum CCS rebate is increasing from 85% to 90%, with those earning a combined family income of $80,000 or less eligible for the highest subsidy.

For those families earning a combined income of between $80,000 and $530,000, the subsidy gradually tapers by 1% for every $5,000 earned. Families with more than one child aged 5 or under in care can still get a higher rate for their second and younger child.

A graph comparing the current CCS and the new CCS appears below (including the discounts applicable to second and subsequent children in care).

(Source: Cheaper Child Care Fact Sheet)

First Nations children will also have an exemption to the Activity Test, providing access to 36 hours a fortnight of subsidised care.

Where does the money go?

With a few exceptions, a families' CCS entitlement is paid directly to the centre and the centre will then use that discount to reduce families' out of pocket fee each day. Even though the centre may be applying the CCS to the fee, they have no power to determine what the CCS amount is or how it is applied, so if you have any issues with your CCS your first port of call should be the CCS Helpdesk (details below).

How do I claim?

Services Australia has a handy tool on their website that explains how to claim the CCS.

Generally, applications are done through your MyGov account - head to the Centrelink section and select the ‘Payment and Claims’ option. The Child Care Subsidy is under the ‘Families’ heading. You’ll need to answer questions and supply documents in relation to your income, activity levels and residency status, amongst other things. Once your claim is submitted you can track it on My Gov.

It is important to note that even after you have been approved for the CCS there a few administrative things that must be done before the CCS can be applied to your fee:

- A CWA (or Complying Written Agreement) must be signed. The CWA is often sent to parents electronically by the centre.

- The child's enrolment at the centre must be confirmed in the parents' Centrelink account. You can't confirm the enrolment until the CWA has been signed.

- The child must physically attend their first day of care. If they are not signed into the centre on their first day, the CCS won't be triggered. If your child is absent on their first day of care, the CCS won't apply to that first day of care - even though it would otherwise apply to absent days.

The source of truth

The source of truth on all things CCS is the Federal Government, which runs a CCS Helpdesk. You can reach the CCS Helpdesk on 1 300 667 276, between the hours of 9am and 5pm from Monday to Friday. You can also email the Helpdesk at ccshelpdesk@education.gov.au.

Questions?

We are always very happy to answer questions or provide assistance where needed. You can reach out to us any time at enquiries@futuro.nsw.edu.au.